In the fast-paced world of day trading, staying informed and inspired is crucial for success. Podcasts offer a convenient way…

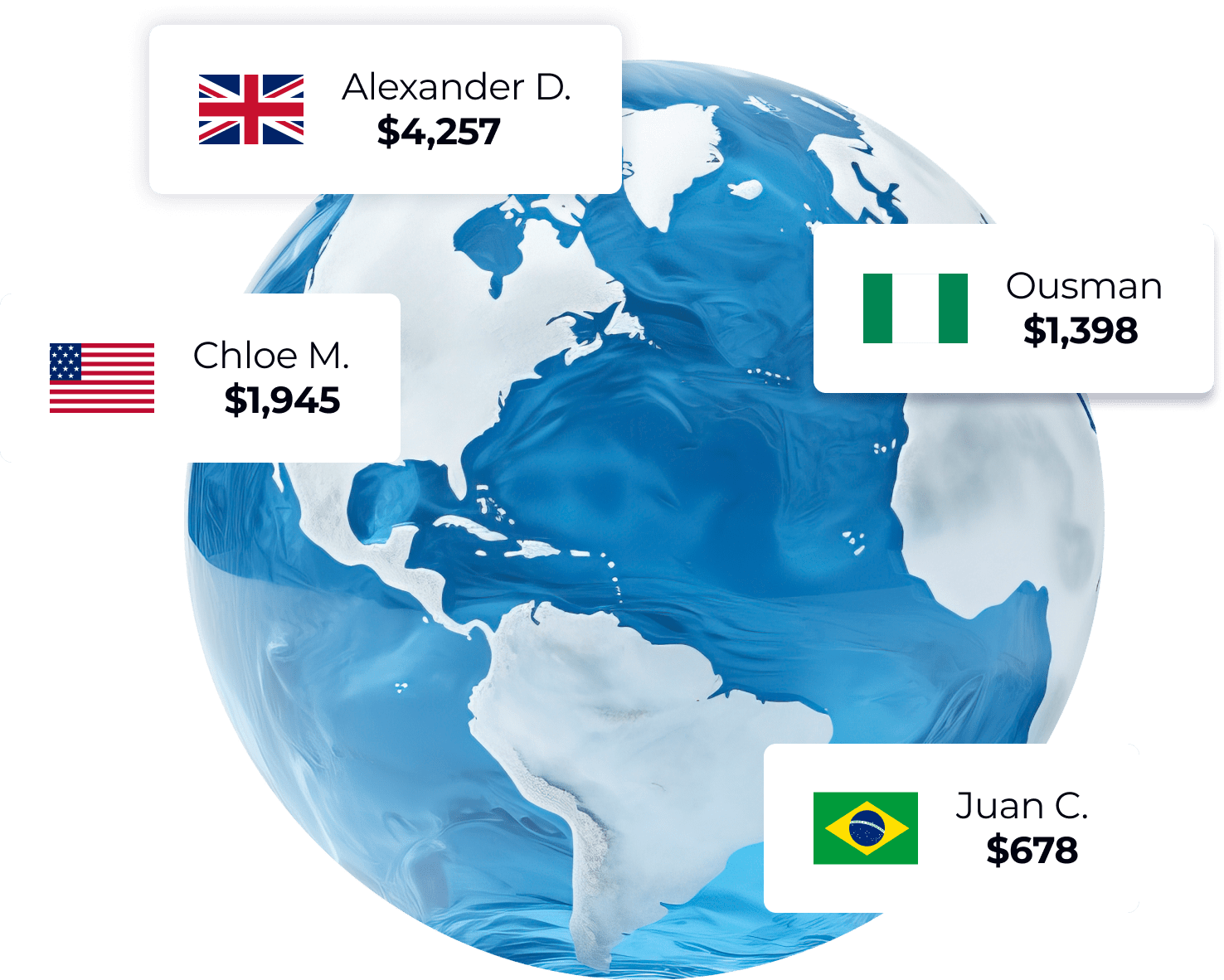

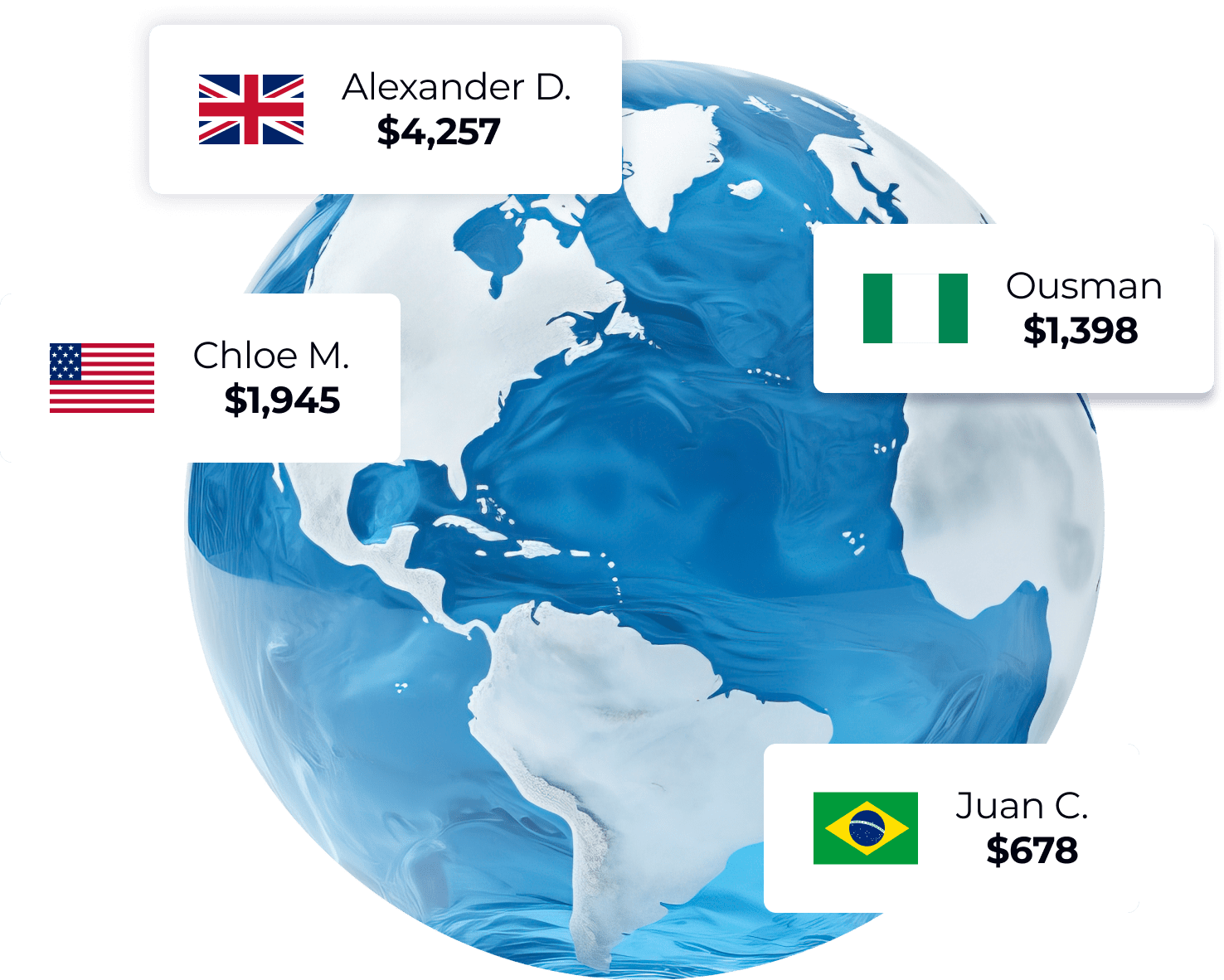

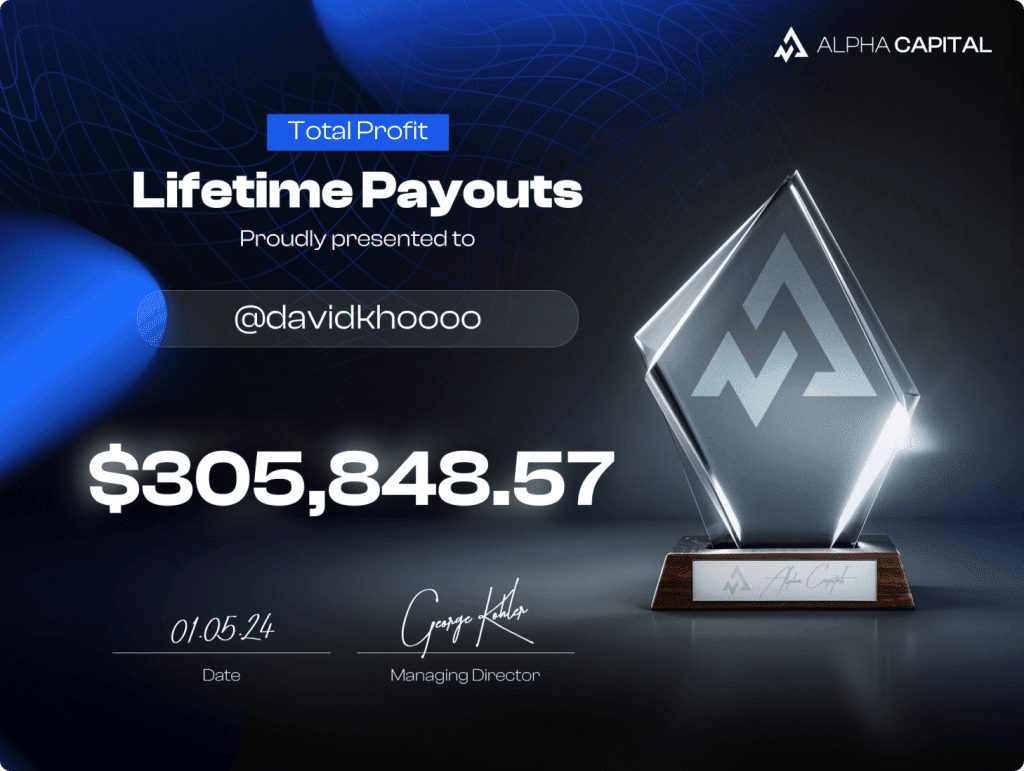

Join 308,000+ traders who trust Alpha Capital Group. Improve with an Alpha analyst account up to $200,000 and earn up to 80% of your simulated profits.

Join 308,000+ traders who trust Alpha Capital Group. Improve with an Alpha analyst account up to $200,000 and earn up to 80% of your simulated profits.

TRUSTED BY TOP BRANDS WORLDWIDE

Maximise your profits without worrying about any commission fees.

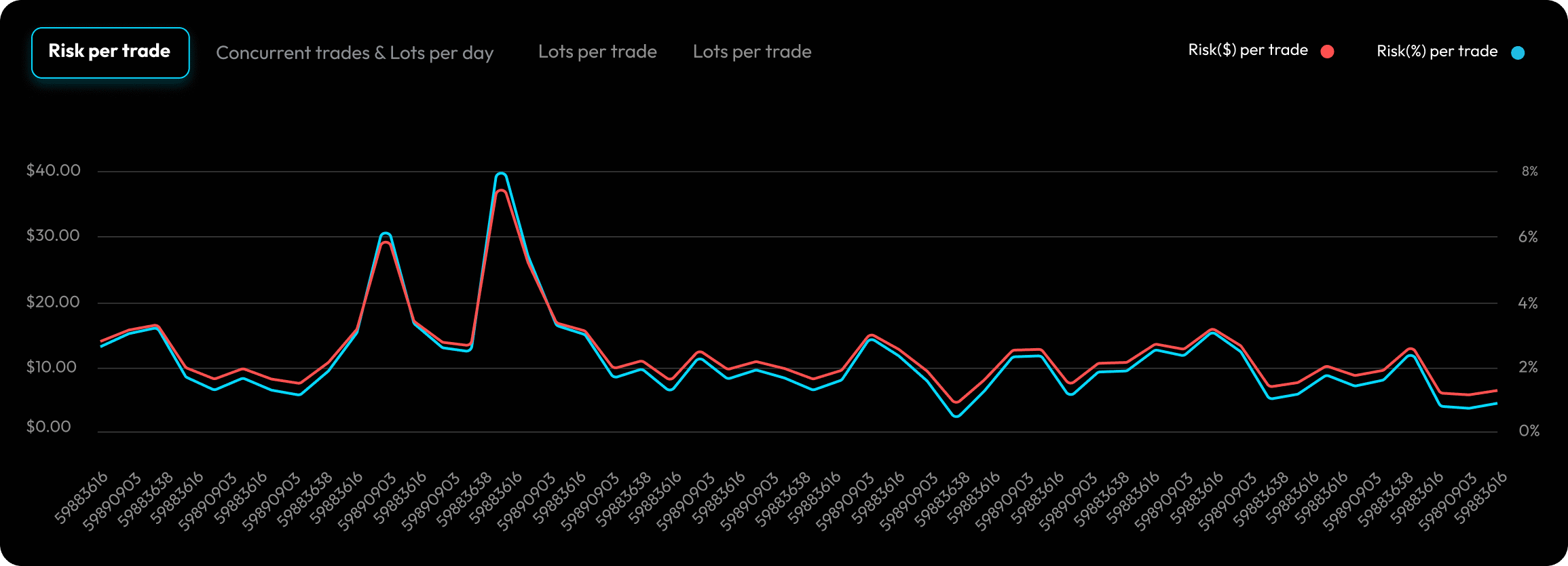

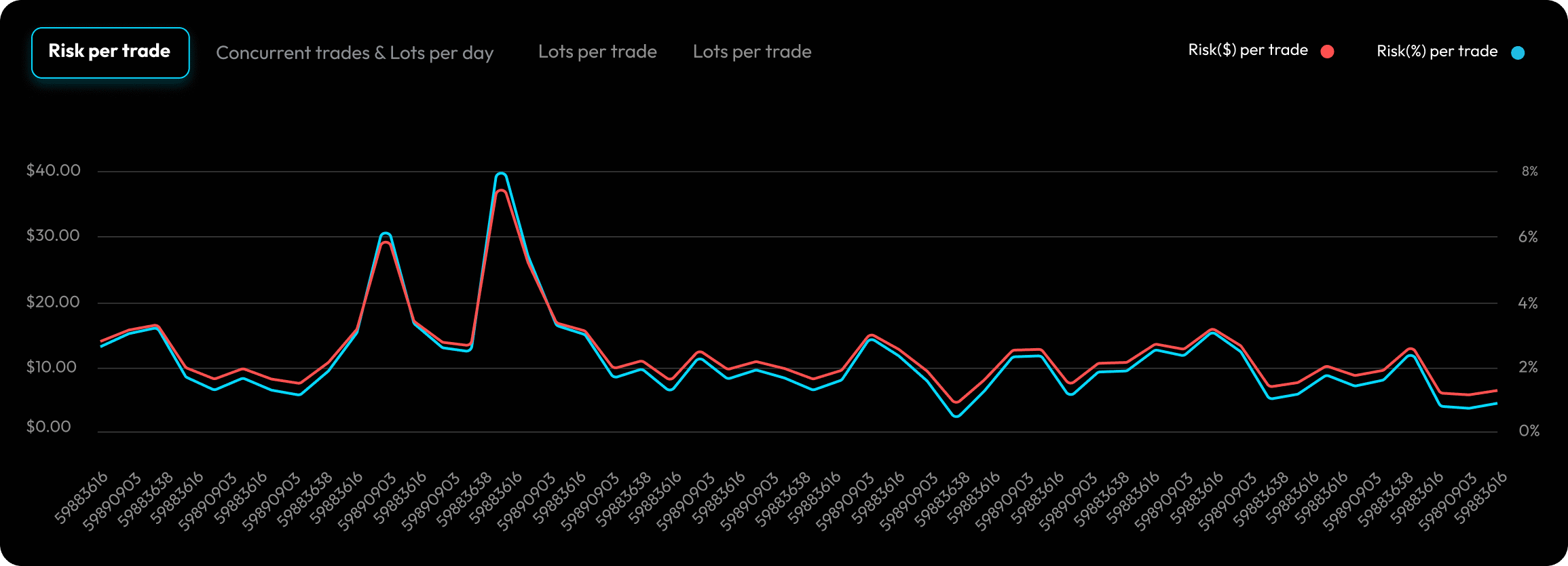

Receive personalised risk assessments tailored to your trading style to manage your risk.

Pick from a diverse range of products tailored to your trading needs and preferences.

Take advantage of unlimited trading days to complete your assessment, trade at your pace and perform on the daily market fluctuations.

Our Partner ACG Markets provides our client the ability to gain access to an institutional trading environment, all conditions and orders simulate real market liquidity, depth of market, executions speeds of sub 70ms targeted.

Receive personalised risk assessments tailored to your trading style to manage your risk.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Complete our standard evaluation to unlock additional monthly performance fees, rewarding your consistency.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Demonstrate your trading prowess and retain the majority of your profits—all at the lowest cost.

Fast-track your success by skipping the evaluation process and start earning profits within hours of opening your account.

Up to 1:100

Unlimited

$500 (10%)

$250 (5%)

N/A

80%

10% ($500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $5,000

Assessment Price: $50

Up to 1:100

Unlimited

$1,000 (10%)

$500 (5%)

N/A

80%

10% ($1000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $10,000

Assessment Price: $97

Up to 1:100

Unlimited

$2,500 (10%)

$1,250 (5%)

N/A

80%

10% ($2500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $25,000

Assessment Price: 197

Up to 1:100

Unlimited

$5,000 (10%)

$2,500 (5%)

N/A

80%

10% ($5000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $50,000

Assessment Price: $297

Up to 1:100

Unlimited

$10,000 (10%)

$5,000 (5%)

N/A

80%

10% ($10,000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $100,000

Assessment Price: $497

Up to 1:100

Unlimited

$20,000 (10%)

$10,000 (5%)

N/A

80%

10% ($20,000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $200,000

Assessment Price: $997

Up to 1:100

Unlimited

$500 (10%)

$250 (5%)

N/A

80%

10% ($500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $5,000

Assessment Price: $50

Up to 1:100

Unlimited

$1,000 (10%)

$500 (5%)

N/A

80%

10% ($1000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $10,000

Assessment Price: $97

Up to 1:100

Unlimited

$2,500 (10%)

$1,250 (5%)

N/A

80%

10% ($2500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $25,000

Assessment Price: 197

Up to 1:100

Unlimited

$5,000 (10%)

$2,500 (5%)

N/A

80%

10% ($5000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $50,000

Assessment Price: $297

Up to 1:100

Unlimited

$10,000 (10%)

$5,000 (5%)

N/A

80%

10% ($10,000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $100,000

Assessment Price: $497

Up to 1:100

Unlimited

$20,000 (10%)

$10,000 (5%)

N/A

80%

10% ($20,000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $200,000

Assessment Price: $997

Up to 1:30

Unlimited

$500 (10%)

$250 (5%)

N/A

80%

10% ($500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Swing: $5,000

Assessment Price: $70

Up to 1:30

Unlimited

$1,000 (10%)

$500 (5%)

N/A

80%

10% ($1000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Swing: $10,000

Assessment Price: $147

Up to 1:30

Unlimited

$2,500 (10%)

$1,250 (5%)

N/A

80%

10% ($2,500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Swing: $25,000

Assessment Price: $147

Leverage is a financial tool that allows traders to control a larger position size with a smaller amount of capital. It magnifies both potential profits and potential losses.

Please trade responsibly and be aware of the risks to your trading performance associated with leverage. Although no capital is at risk on our assessments or Qualified Analyst accounts, leverage can have a significant impact on your trading strategy.

Up to 1:30

There are no maximum trading days imposed during the Assessment stages. You can trade as many days as needed to complete each phase successfully.

Unlimited

To advance through the stages or reach the analyst account, the profit target must be met at each stage.

$5,000 (10%)

$2,500 (5%)

N/A

Performance fees on qualified trader accounts are processed as follows: Requests are available bi-weekly, starting 14 days after your initial trade on your qualified trader account. You can find this date in the account metrics section of your trader’s dashboard The minimum performance fee amount is $100. ($100 gross – $80 net) To qualify for a withdrawal, a minimum profit of $100 must be realized on the account. All performance fee requests will be processed and paid within 2 business days For your first performance fee request, a minimum of 5 trading days is required.

80%

The maximum permissible loss is defined by a fixed absolute drawdown, restricted to a 10% reduction from the initial starting balance.

For clarity, on a $100,000 Assessment, the allowable loss threshold is set at $10,000. Should the account balance or equity decline below $90,000 at any point, this criterion is considered breached. Consistent with our policies regarding maximum daily losses, should the equity dip to the predetermined minimum level, the system will initiate an automatic closure of all trades, resulting in the termination of the account.

10% ($5000)

Our daily loss limit is determined based on 5% of your starting balance for each trading day. This starting balance is the account balance at the close of the daily candle on broker time, which is at 00:00 GMT+2. The open equity (including any floating gains or losses) from the previous trading day is not factored into the maximum daily loss calculation. This means that even if your balance is $100,000 and equity is $101,000, the minimum equity requirement remains at $95,000, allowing you to theoretically lose up to $6,000 during the day, taking into account the floating unrealized profit or loss.

5%

The maximum virtual capital growth on the Alpha Pro Plan is $2 million. Traders who achieve a 10% virtual capital growth on their trading account can request scaling. The scaling amount will be 10% of the initial account balance, allowing the trader to request performance fees and scale simultaneously.

Requesting a Scale up with Alpha Capital Group To request account scaling your account must be at the withdrawal stage. Kindly add to the ‘Reason/Notes’ section of the Performance Fee Request that you would like to join the scaling plan and scale up your account. Additionally, please send an email to [email protected] explicitly stating your request for a scale-up of the account. Please allow a timeframe of 24-48 business hours for the completion of this request. Please note that your new scaled account requires a minimum of 5 trading days before the first Performance Fee is applicable.To scale the account, each time there must be a 10% gain achieved of the account balance, at the time of requesting scaling, the 10% gain must be present in the account (previous withdrawals are not counted)

$2,000,000

There are imposed minimum trading days for each of the assessment stage accounts. If you meet the profit target before this time you will need to continue trading until you meet this criteria.

3 Days

At Alpha Capital Group we currently offer 2 account types. Standard Assessment and Raw assessment. You can select which one you require at Checkout.

For our Standard Assessment, please note that there are no commission fees applicable to trades across all asset classes.

Yes

During the Assessment stage of the Alpha Pro accounts you can trade freely during all news releases. After you pass the Assessment and are a Qualified Trader you should be careful when trading during news releases. Swing accounts can trade freely during all news events.

Yes

Pro Plan:

Assessment stage : Holding trades over the weekend allowed.

Qualified Analyst Account: Holding trades over the weekend not allowed.

Swing plan:

Holding trades over the weekend is allowed at all stages.

However, it is essential to note that this will entail the accrual of swap fees.

Yes

Alpha Swing: $50,000

Assessment Price: 357

Leverage is a financial tool that allows traders to control a larger position size with a smaller amount of capital. It magnifies both potential profits and potential losses.

Please trade responsibly and be aware of the risks to your trading performance associated with leverage. Although no capital is at risk on our assessments or Qualified Analyst accounts, leverage can have a significant impact on your trading strategy.

Up to 1:30

There are no maximum trading days imposed during the Assessment stages. You can trade as many days as needed to complete each phase successfully.

Unlimited

To advance through the stages or reach the analyst account, the profit target must be met at each stage.

$10,000 (10%)

$5,000 (5%)

N/A

Performance fees on qualified trader accounts are processed as follows: Requests are available bi-weekly, starting 14 days after your initial trade on your qualified trader account. You can find this date in the account metrics section of your trader’s dashboard The minimum performance fee amount is $100. ($100 gross – $80 net) To qualify for a withdrawal, a minimum profit of $100 must be realized on the account. All performance fee requests will be processed and paid within 2 business days For your first performance fee request, a minimum of 5 trading days is required.

80%

The maximum permissible loss is defined by a fixed absolute drawdown, restricted to a 10% reduction from the initial starting balance.

For clarity, on a $100,000 Assessment, the allowable loss threshold is set at $10,000. Should the account balance or equity decline below $90,000 at any point, this criterion is considered breached. Consistent with our policies regarding maximum daily losses, should the equity dip to the predetermined minimum level, the system will initiate an automatic closure of all trades, resulting in the termination of the account.

10% ($10,000)

Our daily loss limit is determined based on 5% of your starting balance for each trading day. This starting balance is the account balance at the close of the daily candle on broker time, which is at 00:00 GMT+2. The open equity (including any floating gains or losses) from the previous trading day is not factored into the maximum daily loss calculation. This means that even if your balance is $100,000 and equity is $101,000, the minimum equity requirement remains at $95,000, allowing you to theoretically lose up to $6,000 during the day, taking into account the floating unrealized profit or loss.

5%

The maximum virtual capital growth on the Alpha Pro Plan is $2 million. Traders who achieve a 10% virtual capital growth on their trading account can request scaling. The scaling amount will be 10% of the initial account balance, allowing the trader to request performance fees and scale simultaneously.

Requesting a Scale up with Alpha Capital Group To request account scaling your account must be at the withdrawal stage. Kindly add to the ‘Reason/Notes’ section of the Performance Fee Request that you would like to join the scaling plan and scale up your account. Additionally, please send an email to [email protected] explicitly stating your request for a scale-up of the account. Please allow a timeframe of 24-48 business hours for the completion of this request. Please note that your new scaled account requires a minimum of 5 trading days before the first Performance Fee is applicable.To scale the account, each time there must be a 10% gain achieved of the account balance, at the time of requesting scaling, the 10% gain must be present in the account (previous withdrawals are not counted)

$2,000,000

There are imposed minimum trading days for each of the assessment stage accounts. If you meet the profit target before this time you will need to continue trading until you meet this criteria.

3 Days

At Alpha Capital Group we currently offer 2 account types. Standard Assessment and Raw assessment. You can select which one you require at Checkout.

For our Standard Assessment, please note that there are no commission fees applicable to trades across all asset classes.

Yes

During the Assessment stage of the Alpha Pro accounts you can trade freely during all news releases. After you pass the Assessment and are a Qualified Trader you should be careful when trading during news releases. Swing accounts can trade freely during all news events.

Yes

Pro Plan:

Assessment stage : Holding trades over the weekend allowed.

Qualified Analyst Account: Holding trades over the weekend not allowed.

Swing plan:

Holding trades over the weekend is allowed at all stages.

However, it is essential to note that this will entail the accrual of swap fees.

Yes

Alpha Swing: $100,000

Assessment Price: $577

Leverage is a financial tool that allows traders to control a larger position size with a smaller amount of capital. It magnifies both potential profits and potential losses.

Please trade responsibly and be aware of the risks to your trading performance associated with leverage. Although no capital is at risk on our assessments or Qualified Analyst accounts, leverage can have a significant impact on your trading strategy.

Up to 1:30

There are no maximum trading days imposed during the Assessment stages. You can trade as many days as needed to complete each phase successfully.

Unlimited

To advance through the stages or reach the analyst account, the profit target must be met at each stage.

$20,000 (10%)

$10,000 (5%)

N/A

Performance fees on qualified trader accounts are processed as follows: Requests are available bi-weekly, starting 14 days after your initial trade on your qualified trader account. You can find this date in the account metrics section of your trader’s dashboard The minimum performance fee amount is $100. ($100 gross – $80 net) To qualify for a withdrawal, a minimum profit of $100 must be realized on the account. All performance fee requests will be processed and paid within 2 business days For your first performance fee request, a minimum of 5 trading days is required.

80%

The maximum permissible loss is defined by a fixed absolute drawdown, restricted to a 10% reduction from the initial starting balance.

For clarity, on a $100,000 Assessment, the allowable loss threshold is set at $10,000. Should the account balance or equity decline below $90,000 at any point, this criterion is considered breached. Consistent with our policies regarding maximum daily losses, should the equity dip to the predetermined minimum level, the system will initiate an automatic closure of all trades, resulting in the termination of the account.

10% ($20,000)

Our daily loss limit is determined based on 5% of your starting balance for each trading day. This starting balance is the account balance at the close of the daily candle on broker time, which is at 00:00 GMT+2. The open equity (including any floating gains or losses) from the previous trading day is not factored into the maximum daily loss calculation. This means that even if your balance is $100,000 and equity is $101,000, the minimum equity requirement remains at $95,000, allowing you to theoretically lose up to $6,000 during the day, taking into account the floating unrealized profit or loss.

5%

The maximum virtual capital growth on the Alpha Pro Plan is $2 million. Traders who achieve a 10% virtual capital growth on their trading account can request scaling. The scaling amount will be 10% of the initial account balance, allowing the trader to request performance fees and scale simultaneously.

Requesting a Scale up with Alpha Capital Group To request account scaling your account must be at the withdrawal stage. Kindly add to the ‘Reason/Notes’ section of the Performance Fee Request that you would like to join the scaling plan and scale up your account. Additionally, please send an email to [email protected] explicitly stating your request for a scale-up of the account. Please allow a timeframe of 24-48 business hours for the completion of this request. Please note that your new scaled account requires a minimum of 5 trading days before the first Performance Fee is applicable.To scale the account, each time there must be a 10% gain achieved of the account balance, at the time of requesting scaling, the 10% gain must be present in the account (previous withdrawals are not counted)

$2,000,000

There are imposed minimum trading days for each of the assessment stage accounts. If you meet the profit target before this time you will need to continue trading until you meet this criteria.

3 Days

At Alpha Capital Group we currently offer 2 account types. Standard Assessment and Raw assessment. You can select which one you require at Checkout.

For our Standard Assessment, please note that there are no commission fees applicable to trades across all asset classes.

Yes

During the Assessment stage of the Alpha Pro accounts you can trade freely during all news releases. After you pass the Assessment and are a Qualified Trader you should be careful when trading during news releases. Swing accounts can trade freely during all news events.

Yes

Pro Plan:

Assessment stage : Holding trades over the weekend allowed.

Qualified Analyst Account: Holding trades over the weekend not allowed.

Swing plan:

Holding trades over the weekend is allowed at all stages.

However, it is essential to note that this will entail the accrual of swap fees.

Yes

Alpha Swing: $200,000

Assessment Price: $1097

Up to 1:30

Unlimited

$500 (10%)

$250 (5%)

N/A

80%

10% ($500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Swing: $5,000

Assessment Price: $70

Up to 1:30

Unlimited

$1,000 (10%)

$500 (5%)

N/A

80%

10% ($1000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Swing: $10,000

Assessment Price: $147

Up to 1:30

Unlimited

$2,500 (10%)

$1,250 (5%)

N/A

80%

10% ($2,500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Swing: $25,000

Assessment Price: $147

Leverage is a financial tool that allows traders to control a larger position size with a smaller amount of capital. It magnifies both potential profits and potential losses.

Please trade responsibly and be aware of the risks to your trading performance associated with leverage. Although no capital is at risk on our assessments or Qualified Analyst accounts, leverage can have a significant impact on your trading strategy.

Up to 1:30

There are no maximum trading days imposed during the Assessment stages. You can trade as many days as needed to complete each phase successfully.

Unlimited

To advance through the stages or reach the analyst account, the profit target must be met at each stage.

$5,000 (10%)

$2,500 (5%)

N/A

Performance fees on qualified trader accounts are processed as follows: Requests are available bi-weekly, starting 14 days after your initial trade on your qualified trader account. You can find this date in the account metrics section of your trader’s dashboard The minimum performance fee amount is $100. ($100 gross – $80 net) To qualify for a withdrawal, a minimum profit of $100 must be realized on the account. All performance fee requests will be processed and paid within 2 business days For your first performance fee request, a minimum of 5 trading days is required.

80%

The maximum permissible loss is defined by a fixed absolute drawdown, restricted to a 10% reduction from the initial starting balance.

For clarity, on a $100,000 Assessment, the allowable loss threshold is set at $10,000. Should the account balance or equity decline below $90,000 at any point, this criterion is considered breached. Consistent with our policies regarding maximum daily losses, should the equity dip to the predetermined minimum level, the system will initiate an automatic closure of all trades, resulting in the termination of the account.

10% ($5000)

Our daily loss limit is determined based on 5% of your starting balance for each trading day. This starting balance is the account balance at the close of the daily candle on broker time, which is at 00:00 GMT+2. The open equity (including any floating gains or losses) from the previous trading day is not factored into the maximum daily loss calculation. This means that even if your balance is $100,000 and equity is $101,000, the minimum equity requirement remains at $95,000, allowing you to theoretically lose up to $6,000 during the day, taking into account the floating unrealized profit or loss.

5%

The maximum virtual capital growth on the Alpha Pro Plan is $2 million. Traders who achieve a 10% virtual capital growth on their trading account can request scaling. The scaling amount will be 10% of the initial account balance, allowing the trader to request performance fees and scale simultaneously.

Requesting a Scale up with Alpha Capital Group To request account scaling your account must be at the withdrawal stage. Kindly add to the ‘Reason/Notes’ section of the Performance Fee Request that you would like to join the scaling plan and scale up your account. Additionally, please send an email to [email protected] explicitly stating your request for a scale-up of the account. Please allow a timeframe of 24-48 business hours for the completion of this request. Please note that your new scaled account requires a minimum of 5 trading days before the first Performance Fee is applicable.To scale the account, each time there must be a 10% gain achieved of the account balance, at the time of requesting scaling, the 10% gain must be present in the account (previous withdrawals are not counted)

$2,000,000

There are imposed minimum trading days for each of the assessment stage accounts. If you meet the profit target before this time you will need to continue trading until you meet this criteria.

3 Days

At Alpha Capital Group we currently offer 2 account types. Standard Assessment and Raw assessment. You can select which one you require at Checkout.

For our Standard Assessment, please note that there are no commission fees applicable to trades across all asset classes.

Yes

During the Assessment stage of the Alpha Pro accounts you can trade freely during all news releases. After you pass the Assessment and are a Qualified Trader you should be careful when trading during news releases. Swing accounts can trade freely during all news events.

Yes

Pro Plan:

Assessment stage : Holding trades over the weekend allowed.

Qualified Analyst Account: Holding trades over the weekend not allowed.

Swing plan:

Holding trades over the weekend is allowed at all stages.

However, it is essential to note that this will entail the accrual of swap fees.

Yes

Alpha Swing: $50,000

Assessment Price: 357

Leverage is a financial tool that allows traders to control a larger position size with a smaller amount of capital. It magnifies both potential profits and potential losses.

Please trade responsibly and be aware of the risks to your trading performance associated with leverage. Although no capital is at risk on our assessments or Qualified Analyst accounts, leverage can have a significant impact on your trading strategy.

Up to 1:30

There are no maximum trading days imposed during the Assessment stages. You can trade as many days as needed to complete each phase successfully.

Unlimited

To advance through the stages or reach the analyst account, the profit target must be met at each stage.

$10,000 (10%)

$5,000 (5%)

N/A

Performance fees on qualified trader accounts are processed as follows: Requests are available bi-weekly, starting 14 days after your initial trade on your qualified trader account. You can find this date in the account metrics section of your trader’s dashboard The minimum performance fee amount is $100. ($100 gross – $80 net) To qualify for a withdrawal, a minimum profit of $100 must be realized on the account. All performance fee requests will be processed and paid within 2 business days For your first performance fee request, a minimum of 5 trading days is required.

80%

The maximum permissible loss is defined by a fixed absolute drawdown, restricted to a 10% reduction from the initial starting balance.

For clarity, on a $100,000 Assessment, the allowable loss threshold is set at $10,000. Should the account balance or equity decline below $90,000 at any point, this criterion is considered breached. Consistent with our policies regarding maximum daily losses, should the equity dip to the predetermined minimum level, the system will initiate an automatic closure of all trades, resulting in the termination of the account.

10% ($10,000)

Our daily loss limit is determined based on 5% of your starting balance for each trading day. This starting balance is the account balance at the close of the daily candle on broker time, which is at 00:00 GMT+2. The open equity (including any floating gains or losses) from the previous trading day is not factored into the maximum daily loss calculation. This means that even if your balance is $100,000 and equity is $101,000, the minimum equity requirement remains at $95,000, allowing you to theoretically lose up to $6,000 during the day, taking into account the floating unrealized profit or loss.

5%

The maximum virtual capital growth on the Alpha Pro Plan is $2 million. Traders who achieve a 10% virtual capital growth on their trading account can request scaling. The scaling amount will be 10% of the initial account balance, allowing the trader to request performance fees and scale simultaneously.

Requesting a Scale up with Alpha Capital Group To request account scaling your account must be at the withdrawal stage. Kindly add to the ‘Reason/Notes’ section of the Performance Fee Request that you would like to join the scaling plan and scale up your account. Additionally, please send an email to [email protected] explicitly stating your request for a scale-up of the account. Please allow a timeframe of 24-48 business hours for the completion of this request. Please note that your new scaled account requires a minimum of 5 trading days before the first Performance Fee is applicable.To scale the account, each time there must be a 10% gain achieved of the account balance, at the time of requesting scaling, the 10% gain must be present in the account (previous withdrawals are not counted)

$2,000,000

There are imposed minimum trading days for each of the assessment stage accounts. If you meet the profit target before this time you will need to continue trading until you meet this criteria.

3 Days

At Alpha Capital Group we currently offer 2 account types. Standard Assessment and Raw assessment. You can select which one you require at Checkout.

For our Standard Assessment, please note that there are no commission fees applicable to trades across all asset classes.

Yes

During the Assessment stage of the Alpha Pro accounts you can trade freely during all news releases. After you pass the Assessment and are a Qualified Trader you should be careful when trading during news releases. Swing accounts can trade freely during all news events.

Yes

Pro Plan:

Assessment stage : Holding trades over the weekend allowed.

Qualified Analyst Account: Holding trades over the weekend not allowed.

Swing plan:

Holding trades over the weekend is allowed at all stages.

However, it is essential to note that this will entail the accrual of swap fees.

Yes

Alpha Swing: $100,000

Assessment Price: $577

Leverage is a financial tool that allows traders to control a larger position size with a smaller amount of capital. It magnifies both potential profits and potential losses.

Please trade responsibly and be aware of the risks to your trading performance associated with leverage. Although no capital is at risk on our assessments or Qualified Analyst accounts, leverage can have a significant impact on your trading strategy.

Up to 1:30

There are no maximum trading days imposed during the Assessment stages. You can trade as many days as needed to complete each phase successfully.

Unlimited

To advance through the stages or reach the analyst account, the profit target must be met at each stage.

$20,000 (10%)

$10,000 (5%)

N/A

Performance fees on qualified trader accounts are processed as follows: Requests are available bi-weekly, starting 14 days after your initial trade on your qualified trader account. You can find this date in the account metrics section of your trader’s dashboard The minimum performance fee amount is $100. ($100 gross – $80 net) To qualify for a withdrawal, a minimum profit of $100 must be realized on the account. All performance fee requests will be processed and paid within 2 business days For your first performance fee request, a minimum of 5 trading days is required.

80%

The maximum permissible loss is defined by a fixed absolute drawdown, restricted to a 10% reduction from the initial starting balance.

For clarity, on a $100,000 Assessment, the allowable loss threshold is set at $10,000. Should the account balance or equity decline below $90,000 at any point, this criterion is considered breached. Consistent with our policies regarding maximum daily losses, should the equity dip to the predetermined minimum level, the system will initiate an automatic closure of all trades, resulting in the termination of the account.

10% ($20,000)

Our daily loss limit is determined based on 5% of your starting balance for each trading day. This starting balance is the account balance at the close of the daily candle on broker time, which is at 00:00 GMT+2. The open equity (including any floating gains or losses) from the previous trading day is not factored into the maximum daily loss calculation. This means that even if your balance is $100,000 and equity is $101,000, the minimum equity requirement remains at $95,000, allowing you to theoretically lose up to $6,000 during the day, taking into account the floating unrealized profit or loss.

5%

The maximum virtual capital growth on the Alpha Pro Plan is $2 million. Traders who achieve a 10% virtual capital growth on their trading account can request scaling. The scaling amount will be 10% of the initial account balance, allowing the trader to request performance fees and scale simultaneously.

Requesting a Scale up with Alpha Capital Group To request account scaling your account must be at the withdrawal stage. Kindly add to the ‘Reason/Notes’ section of the Performance Fee Request that you would like to join the scaling plan and scale up your account. Additionally, please send an email to [email protected] explicitly stating your request for a scale-up of the account. Please allow a timeframe of 24-48 business hours for the completion of this request. Please note that your new scaled account requires a minimum of 5 trading days before the first Performance Fee is applicable.To scale the account, each time there must be a 10% gain achieved of the account balance, at the time of requesting scaling, the 10% gain must be present in the account (previous withdrawals are not counted)

$2,000,000

There are imposed minimum trading days for each of the assessment stage accounts. If you meet the profit target before this time you will need to continue trading until you meet this criteria.

3 Days

At Alpha Capital Group we currently offer 2 account types. Standard Assessment and Raw assessment. You can select which one you require at Checkout.

For our Standard Assessment, please note that there are no commission fees applicable to trades across all asset classes.

Yes

During the Assessment stage of the Alpha Pro accounts you can trade freely during all news releases. After you pass the Assessment and are a Qualified Trader you should be careful when trading during news releases. Swing accounts can trade freely during all news events.

Yes

Pro Plan:

Assessment stage : Holding trades over the weekend allowed.

Qualified Analyst Account: Holding trades over the weekend not allowed.

Swing plan:

Holding trades over the weekend is allowed at all stages.

However, it is essential to note that this will entail the accrual of swap fees.

Yes

Alpha Swing: $200,000

Assessment Price: $1097

Up to 1:100

Unlimited

$500 (10%)

$250 (5%)

N/A

80%

10% ($500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $5,000

Assessment Price: $50

Up to 1:100

Unlimited

$1,000 (10%)

$500 (5%)

N/A

80%

10% ($1000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $10,000

Assessment Price: $97

Up to 1:100

Unlimited

$2,500 (10%)

$1,250 (5%)

N/A

80%

10% ($2500)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $25,000

Assessment Price: 197

Up to 1:100

Unlimited

$5,000 (10%)

$2,500 (5%)

N/A

80%

10% ($5000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $50,000

Assessment Price: $297

Up to 1:100

Unlimited

$10,000 (10%)

$5,000 (5%)

N/A

80%

10% ($10,000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $100,000

Assessment Price: $497

Up to 1:100

Unlimited

$20,000 (10%)

$10,000 (5%)

N/A

80%

10% ($20,000)

5%

$2,000,000

3 Days

Yes

Yes

Yes

Alpha Pro: $200,000

Assessment Price: $997

1:30

Unlimited

N/A

$500 (10%)

N/A

80%

$300 (6%)

$200 (4%)

$2,000,000

1 Day

Yes

Yes (5 Min Window)

Yes

50% Consistency

2% Minimum Profit

1:30

Unlimited

N/A

$1,000 (10%)

N/A

80%

$600 (6%)

$400 (4%)

$2,000,000

1 Day

Yes

Yes (5 Min Window)

Yes

50% Consistency

2% Minimum Profit

Alpha One: $10,000

Assessment Price: $97

1:30

Unlimited

N/A

$2,500 (10%)

N/A

80%

$1,500 (6%)

$1,000 (4%)

$2,000,000

1 Day

Yes

Yes (5 Min Window)

Yes

50% Consistency

2% Min Profit

Alpha One: $25,000

Assessment Price: 197

1:30

Unlimited

N/A

$5,000 (10%)

N/A

80%

$3,000 (6%)

$2,000 (4%)

$2,000,000

1 Day

Yes

Yes (5 Min Window)

Yes

50% Consistency

2% Minimum Profit

Alpha One: $50,000

Assessment Price: $297

1:30

Unlimited

N/A

$10,000 (10%)

N/A

80%

$6000 (6%)

$4,000 (4%)

$2,000,000

1 Day

Yes

Yes (5 Min Window)

Yes

50% Consistency

2% Minimum Profit

Alpha One: $100,000

Assessment Price: $497

1:30

Unlimited

N/A

$20,000 (10%)

N/A

80%

$12,000 (6%)

$8,000 (4%)

$2,000,000

1 Day

Yes

Yes (5 Min Window)

Yes

50% Consistency

2% Min Profit

Alpha One: $200,000

Assessment Price: $997

Dive into the proven strategies and expert insights that drive the success of our elite analysts, paving the way for your own trading triumphs with Alpha Capital.

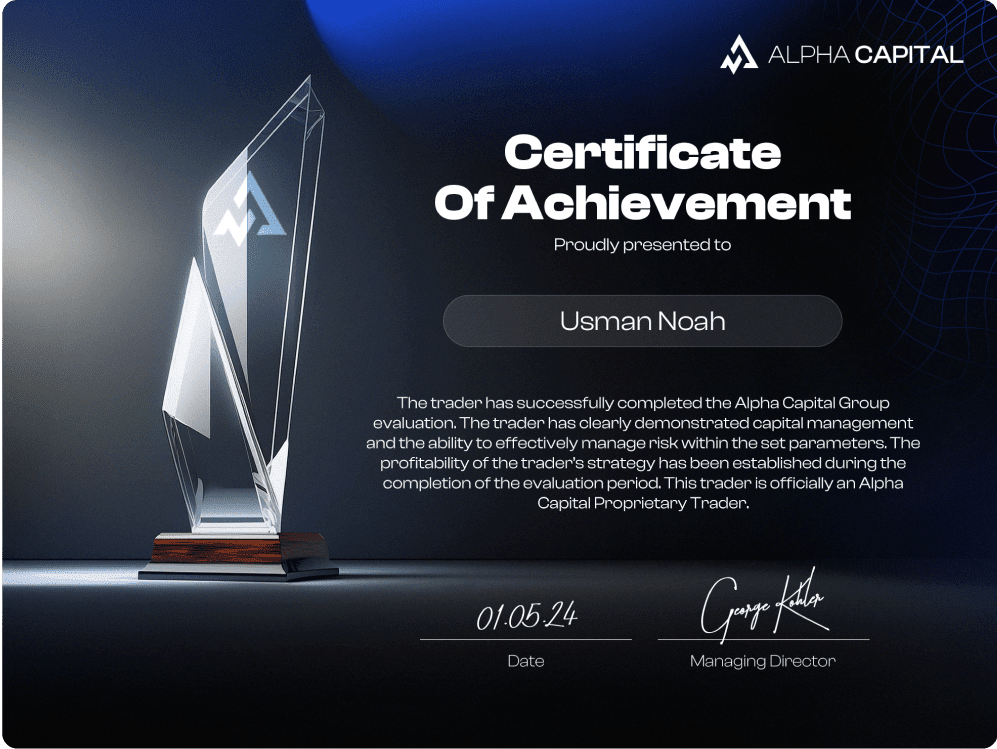

Start your path to becoming an Alpha Analyst by taking on the Phase 1 trading challenge. Execute virtual trades at your own pace—there’s no time limit—while avoiding the maximum drawdown. Your goal is to achieve an 8% virtual profit target. Once you’ve met these objectives, you’ll be ready to advance to the next stage of your trading journey.

In Phase 2, you’ll have the chance to solidify your trading track record. Without any time constraints, focus on reaching a 5% virtual profit target. Upon successful completion, you’ll be certified as an official Alpha Analyst, demonstrating your trading expertise and readiness to excel.

In Phase 2, you’ll have the chance to solidify your trading track record. Without any time constraints, focus on reaching a 5% virtual profit target. Upon successful completion, you’ll be certified as an official Alpha Analyst, demonstrating your trading expertise and readiness to excel.

Alpha Futures elevates proprietary futures trading by offering a cutting-edge platform that utilises advanced, in-house technology. This entity is integral to Alpha Capital Group’s mission, benefiting from the same innovative infrastructure that drives our commitment to exceptional trading experiences.

ACG Markets, our regulated broker licensed in the Seychelles, offers a secure and compliant gateway to global financial markets. With a strong focus on regulatory excellence and competitive access, ACG Markets ensures that your trading is supported by a robust and reliable foundation.

At Funded Peaks, we take pride in our role as an evaluation firm, providing comprehensive and compliant simulated…

At Funded Peaks, we take pride in our role as an evaluation firm, providing comprehensive and compliant simulated…

At Funded Peaks, we take pride in our role as an evaluation firm, providing comprehensive and compliant simulated…

In the fast-paced world of day trading, staying informed and inspired is crucial for success. Podcasts offer a convenient way…

Embarking on a trading journey can be both exciting and daunting. With a myriad of trading styles and strategies available,…

Gold has long been a favorite among day traders, offering a unique blend of volatility, liquidity, and market dynamics that…

In the fast-paced world of day trading, staying informed and inspired is crucial for success. Podcasts offer a convenient way…

Embarking on a trading journey can be both exciting and daunting. With a myriad of trading styles and strategies available,…

Gold has long been a favorite among day traders, offering a unique blend of volatility, liquidity, and market dynamics that…

Identifying trend reversals in financial markets is a crucial skill for traders and investors. Recognizing when a trend is losing…

Short-term trading is a demanding field that requires traders to be agile, informed, and strategic. To excel, traders must develop…

In the world of trading, two popular strategies often come to the forefront: day trading and swing trading. Each approach…

At Alpha Capital Group, we understand that trading with a proprietary firm offers unique opportunities and challenges. Our goal is…

In the ever-evolving landscape of financial trading, strategies that offer a deeper understanding of market dynamics are highly sought after.…